Climate change creates risks and opportunities across society. Risks exist in financial markets, including the risk driven by large financial organisations providing limited information on how climate change affects investments. In part, this is due to a constrained understanding of how climate change will impact their operations. As a result, this varied understanding has seen inconsistent reporting of climate related information. The Productivity Commission says we are seeing an “ongoing and systemic overvaluation of emissions-intensive activities” resulting in investments made without knowing the full story. What opportunities exist to ensure that investments are made with confidence and produce better climate outcomes? This is where climate related financial disclosures come into play.

What are climate related financial disclosures and why do we need them?

Climate related financial disclosures provide information to investors about what a company is doing to mitigate climate change risks. This extends to how that company is governed. Although environmental, social, and governance are important aspects for many businesses, we are now seeing climate and sustainability reporting becoming crucial topics.

The goal of mandatory climate-related disclosures is to:

- ensure that the effects of climate change are routinely considered in business, investment, lending and insurance underwriting decisions

- help climate reporting entities better demonstrate responsibility and foresight when considering climate issues

- lead to more efficient allocation of capital, and help smooth the transition to a more sustainable, low emissions economy.

If investors know more about how much, how often, and where an entity is spending its money, then they can make better informed decisions. Not knowing the full picture before investing significant amounts of money creates unnecessary and avoidable risk. This can come about from not knowing the full extent of risks within value chains, scope 3 emissions, or future investments, for example.

Risks will always exist (e.g. physical location, transition risks), but ultimately, it is important to manage those risks, including understanding what companies are doing to address climate change issues. However, with risk comes opportunity. Better insights can lead to a better understanding of levels of risk that come with investments and a better understanding of what climate action needs to be taken.

What is the Task force on Climate-related Financial Disclosures (TCFD)

Following international best practice is a wise thing to do in any industry. The blueprint to look at, is the Taskforce for Climate related Financial Disclosures (TCFD). The TCFD was created in 2015 by the Financial Stability Board to develop consistent climate-related financial risk disclosures. To date, this has been the leading guidance on climate reporting and has received widespread support globally. The TCFD is built on four core elements; governance, risk management, strategy, and metrics and targets (see Figure 1).

Figure 1: the core elements of TCFD. Source: TCFD final report, June 2017

Will the External Reporting Board (XRB) make climate-related disclosures mandatory in New Zealand?

In September 2020, New Zealand announced it would become the first country requiring the financial sector to report on climate risks. The proposed legislation became law in October 2021, with the passing of the Financial Sector (Climate-related Disclosures and Other Matters) Amendment Bill passed. As a result, the External Reporting Board (XRB) now has a mandate to issue climate standards as part of a climate-related disclosures framework, and guidance on non-financial matters. The Amendment sits within the Financial Markets Conduct Act 2013 (FMC Act), the Financial Reporting Act 2013, and the Public Audit Act 2021.

The new law is centred around the TCFD framework and initially requires about 200 large financial institutions covered by the FMC Act to begin making climate related disclosures, including the following metrics and targets:

- Cross-industry metric categories (including Scope 1, 2 and 3 greenhouse gas (GHG) emissions)

- Industry-based metrics

- Key performance indicators

- Targets, and performance against targets

Improving transparency and revealing climate related information within financial markets reduces risks, increases resilience within those markets, and shows international leadership. Entities covered by the requirements will have to make annual disclosures, covering governance arrangements, risk management, and strategies for mitigating any climate change impacts. If businesses are unable to disclose, they must explain why. This is known as a “comply or explain” approach.

These reporting mechanisms will be monitored, reported, and enforced by the Financial Markets authority. The XRB will issue three new standards in December 2022 which will apply to annual reporting periods beginning on or after 1 January 2023. These standards will be:

- Aotearoa New Zealand Climate Standard 1: Climate-related Disclosures (NZ CS1)

- Aotearoa New Zealand Climate Standard 2: Adoption of Climate-related Disclosures (NZ CS2)

- Aotearoa New Zealand Climate Standard 3: General Requirements for Climate-related Disclosures (NZ CS3).

This will mean climate-related disclosures will be mandatory to disclose for accounting periods that start on or after 1 January 2023 for the following entities:

- large, listed companies with a market capitalisation of more than $60 million;

- large licensed insurers, registered banks, credit unions, building societies and managers of investment schemes with more than $1 billion in assets;

- and some Crown financial institutions (via letters of expectation), such as ACC and the NZ Super Fund.

The greenhouse gas emissions numbers included within reporting companies' climate statement need to be assured. These standards are disclosure standards and do not prescribe the measurement standards that should be used to prepare the greenhouse gas numbers included within the disclosure. The XRB has confirmed that inventories prepared under the GHG protocol or ISO would be acceptable. All XRB standards need to be free and publicly available, whereas ISO standards would need to be purchased. This disclosure framework helps New Zealand meet its broader climate goals as financial disclosures can provide clearer and cleaner investment pathways, aiding the transition to a low-carbon economy.

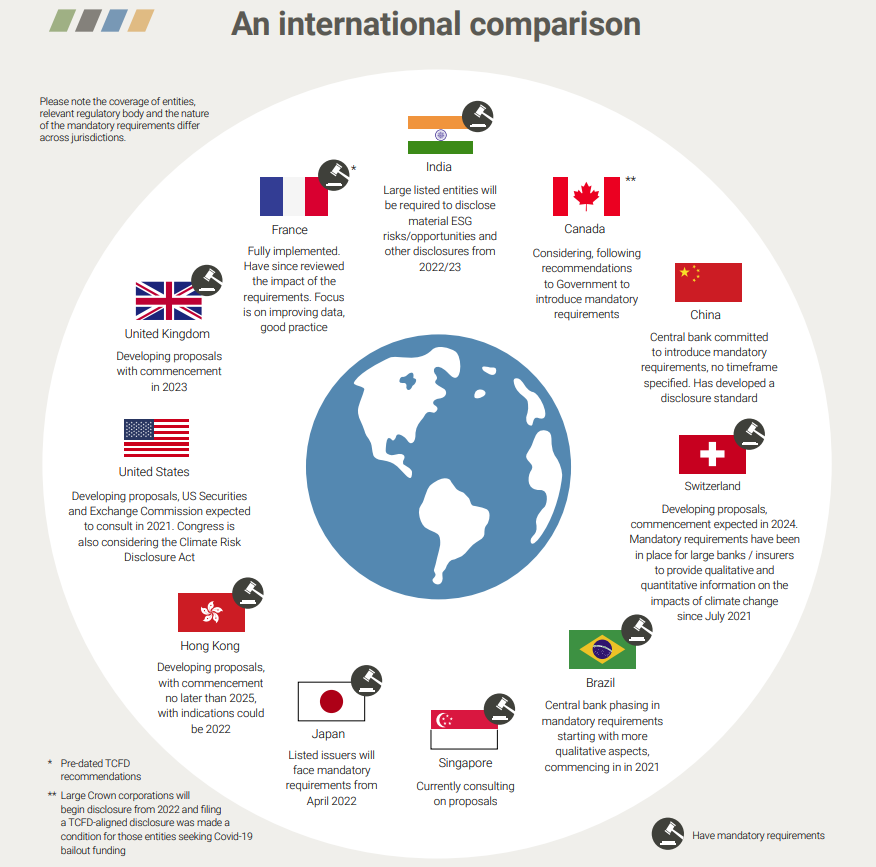

Climate related financial risks can also be factored into other legislation. For example, the National Adaptation Plan, released in August 2022, outlined what needs to be done to respond to risks across the financial system. A simple international comparison is shown in Figure 2 below:

Figure 2: an international comparison of climate related financial disclosures. Source: XRB

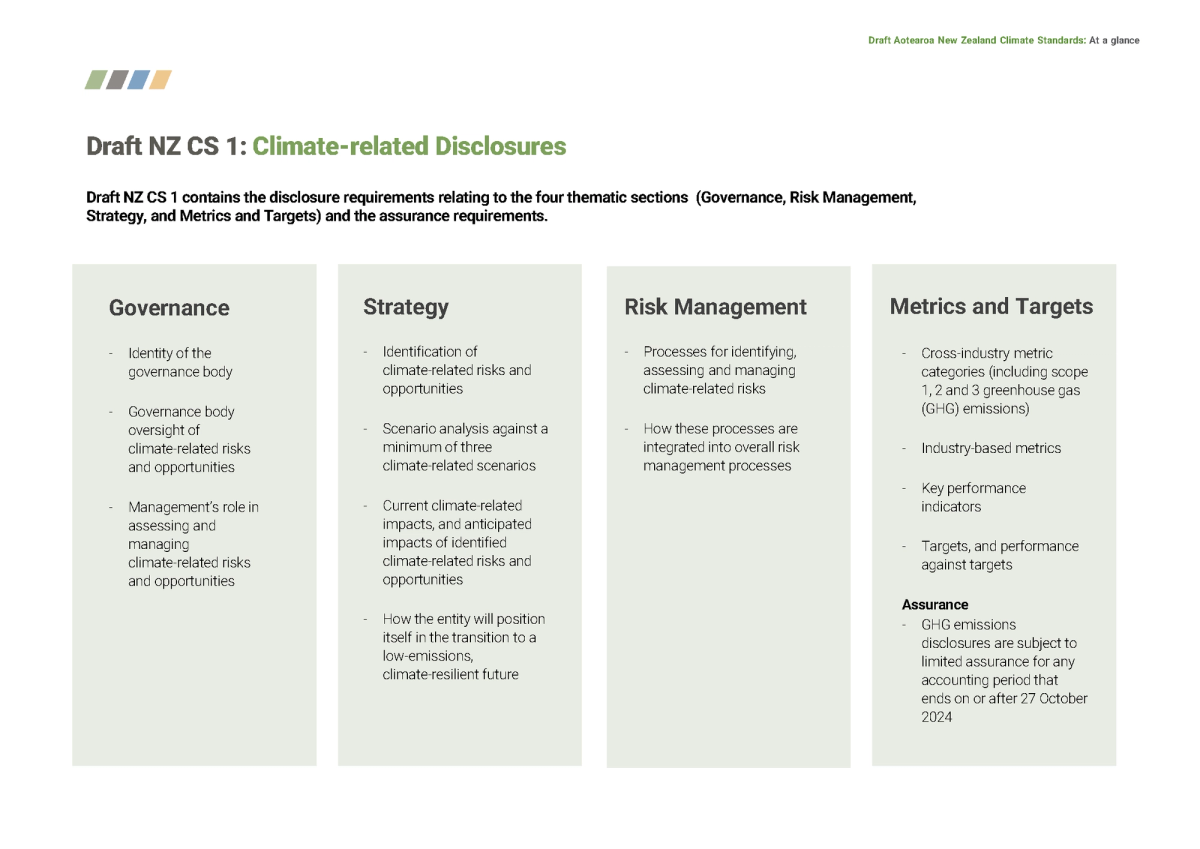

Governance disclosures provide important information on board oversight, such as the nature and quality of that oversight. Risk management disclosures are about the processes used to identify, assess and manage climate related risks. From there, it’s about how these are integrated into the overall risk management processes. The strategy component encompasses the known and potential impacts of climate related risks, as well as the opportunities for the organisation, both in the medium and long-term. Finally, the metrics and targets being used to assess risks and opportunities must be in line with the strategy and risk management process. This should include disclosing Scope 1, 2 and 3 emissions and the relevant risks.

The benefits of this level of disclosure fall into three broad categories. These are:

- Risk assessment – more effectively evaluate climate-related risks to your company, its suppliers, and competitors

- Capital allocation – to make better-informed decisions on where and when to allocate your capital

- Strategic planning – to better evaluate risks and exposures over the short, medium, and long term.

Figure 3 outlines recommended disclosures for each of the four key factors:

Figure 3: Recommendation disclosures for governance, strategy, risk management, and metrics and targets. Source: TCFD final report, June 2017

What TCFD and XRB means for Toitū clients

The TCFD framework and the relevant New Zealand legislation can help potential investors understand the full spectrum of climate impacts. As well as outlining the risks, opportunities can also be presented because of this legislation. Both the entity needing to declare information and potential investors can benefit from reduced risk, increased certainty, and investment decisions being made that consider the long-term climate impacts.

To align with the XRB standards, we can expect to see improved Scope 3 GHG emissions disclosures. Toitū clients can trigger cascading action across their supply chains with early and comprehensive supply chain engagement. Taking such action will reduce emissions and help Aotearoa succeed in its transition to a low carbon economy. Furthermore, clients might expect more discussions about supply chain emissions data with big companies who will be required to report under the new XRB standards or similar reporting.

Toitū Envirocare has been involved in the consultation process of the XRB standard to ensure it meets international science best-practice and as carbon accountant, we are well placed to support new and existing clients measure and verify their data. Contact us if you’d like to speak with our technical team on meeting your reporting requirements.

Summary

- In the past, disclosures from financial institutions have been lacking, incomplete or inconsistent. To address this, Aotearoa New Zealand passed legislation in October 2021 that requires large financial institutions and businesses to outline their climate risks

- As a result of more disclosures, certainty increases, which can result in more investor confidence and comparable data. While eliminating risk isn’t realistic, appropriate risk identification and management is important for investors

- This is important with respect to national and international climate goals, as known climate risks can shift the demand to solutions more in line with a lower-carbon economy. As momentum increases, opportunities for investors that are in line with Paris climate goals can and will become more prominent, and pursued with increasing certainty

- Toitū clients can expect more extensive supply chain engagement and emissions reductions because of this legislation.

Glossary

Climate related financial disclosures – providing information to investors about what a company is doing to mitigate climate change risks. This extends to how that company is governed

Climate statement – in relation to a reporting entity and a balance date, this is the climate-related disclosures for the entity as at the balance date, or in relation to the accounting period ending at the balance date, that are required to be prepared in respect of the entity by an applicable climate standard

Comply or explain – to comply with the legislation requirements, and if this is not adhered to a full explanation is required as to why these requirements were not met

Disclosure – making new or previously hidden information known

ESG – Environmental, Social, and Governance. These are non-financial factors that are analysed and reported on to identify risks and opportunities

FMA – Financial Markets Authority

Governance – The system by which an entity is directed and controlled in the interests of shareholders and other stakeholders.

Opportunity – the chance to increase investment value

Risk – uncertainty with respect to investments

Scope 3 emissions – All indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions

TCFD – Taskforce for Climate related Financial Disclosure

XRB – External Reporting Board

References

https://assets.bbhub.io/company/sites/60/2021/10/FINAL-2017-TCFD-Report.pdf

https://www.beehive.govt.nz/release/new-zealand-first-world-require-climate-risk-reporting

https://www.xrb.govt.nz/standards/climate-related-disclosures/consultation-and-engagement/

https://www.xrb.govt.nz/dmsdocument/4182